Search

IC Customer Support (66) 0 2666 9449 (20 Lines) l csu@ic.or.th l Emergency (System Failure) 098 553 0447

บริการงานแปลเอกสาร

Uncategorised (77)

|

ลำดับ |

งานบริการ |

แบบฟอร์มขอใช้บริการ |

ข่าวประกาศ |

|---|---|---|---|

| 1 | งานฐานข้อมูล (Database) | ดูแบบฟอร์ม | - |

| 2 | งานสั่งปล่อยวัตถุดิบ (Raw Material) | ดูแบบฟอร์ม | - |

| 3 | งานตัดบัญชีวัตถุดิบ (Raw Material Export) | ดูแบบฟอร์ม | ดูประกาศ |

| 4 | งานสั่งปล่อยเครื่องจักร (Machinery) | ดูแบบฟอร์ม | - |

| 5 | Counter Service | ดูแบบฟอร์ม | - |

| 6 | บริการด้านการเงิน (Accounting-Financial) | ดูแบบฟอร์ม | - |

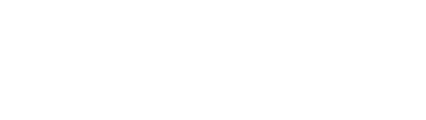

| 7 | อัตราค่าบริการ | ดูแบบฟอร์ม | - |

| 8 | แบบฟอร์มขอเปลี่ยนแปลงข้อมูลบริษัทตามบัตรส่งเสริม | ดูแบบฟอร์ม | - |

| 9 |

แบบฟอร์มหนังสือแจ้งกรณีไม่มีใบทะเบียนภาษีมูลค่าเพิ่ม |

ดูแบบฟอร์ม | - |

| 10 | ดาวน์โหลดแบบฟอร์มระบบ RMTS | ดูแบบฟอร์ม | ดูประกาศ |

แนวปฏิบัติสำหรับการใช้งานระบบงานฐานข้อมูล RMTS Online

Written by Dev DiTC

1. รายละเอียดวิธีการคีย์ข้อมูลไฟล์ต่าง ๆ เบื้องต้น ผ่านคลิป VDO จำนวน 9 EP.

(ต้องการดาวน์โหลด คลิก)

2. ดาวน์โหลดแบบฟอร์มหรือโครงสร้างการคีย์ข้อมูล

(ต้องการดาวน์โหลด คลิก)

3. ดาวน์โหลดคู่มือการใช้งานระบบ เพื่อศึกษารายละเอียดการคีย์ข้อมูลและการใช้งานระบบ

(ต้องการดาวน์โหลด คลิก)

4. กรณีมีข้อสงสัย ต้องการสอบถามข้อมูลเพิ่มเติม สามารถส่งข้อมูลสอบถาม มายัง e-mail : csu@ic.or.th

| 1. RMTS system service | ---Within 2 working days | |||

| - submits raw material list and production formula and Raw material stock adjustment |

||||

| 1.2 Release Raw Material service | ---Within 3 hour | |||

| - Release Raw Material | ||||

| 1.3 Adjustment of Raw Material Stock Balance service |

---Within 3 working days | |||

| - Submits Adjustment of Raw Material Stock Balance | ||||

| 1.4 Cancellation of Raw Material Release service |

---Within 3 hour | |||

| - Applying for Cancellation of Raw Material Release | ||||

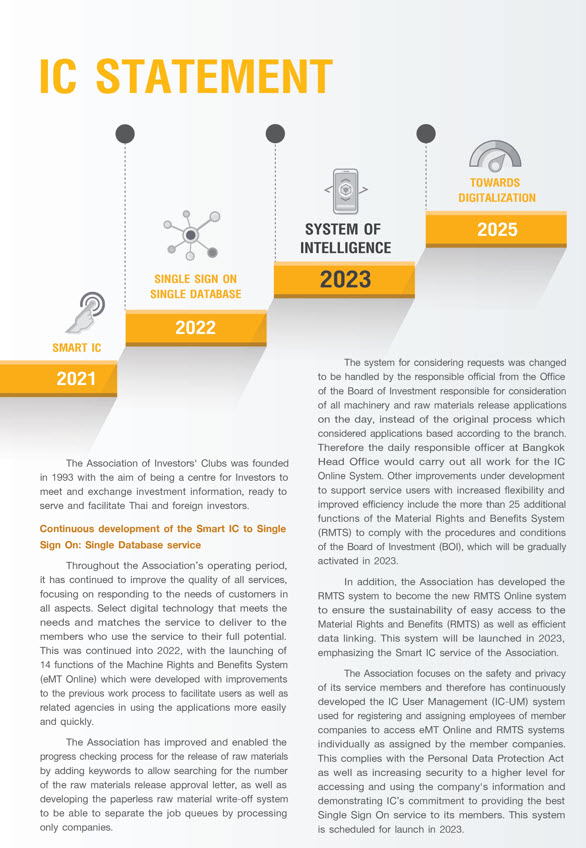

Raw Materials Tracking System (RMTS) Service

IC provides the issuance of permission letter for exercising raw material import benefits, so called “material release letter and maximum stock balance adjustment” as prescribed in Section 30 of the Investment Promotion Act B.E. 2520, as amended by the Investment Promotion Act (No.2) B.E.2534, and as stated in sections 36 (1), (2) regarding import duty exemptions on raw and essential materials brought in for production, mixing, or assembly, or exported commodities, as exemption of import duties for the promoted party who receives promotion to import for re-exports purpose.

To ensure that the Raw Material Tracking System offers convenient and accuracy to the clients, the Investor Club Association is committed to issue documents used for import of raw materials within 3 hours, and update the balance of the raw material stock account within 3 days counting from the time of request.

Machinery and equipment release letter through the Electronic Machine Tracking System (eMT)

IC provides the issuance of letter for exercising machinery import benefits, so called “machinery and equipment release letter” as prescribed in Section 28 and 29 of the Investment Promotion Act B.E. 2520, as amended by the Investment Promotion Act (No.2) B.E.2534. through the Electronics Machine Tracking System (eMT). Investor Club Association is committed to issue the documents within 3 hours from the time of submitted request.

Documents required for membership applications

1. IC application form.

2. I.D. card ( for individual)

3. Copy of the promoted certificate from the BOI ( front page – for promoted companies )

4. Memorandum of Association ( for non-promoted companies )

Application process and fees

1. Apply directly or by fax to 0 2936 1441-2 or e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

2. Payment by cash or cheque paid to “ Investor Club “ at IC office, 16th. floor

3. Payment by Bill Payment

IC received right to waiver with holding tax charge according to article 12/1 (2) according to Revenue Department announcement Tor.Bor. 101.2544.

Download Application From IC and Bill Payment

1. Application From of Investor Club Association Membership

Interested parties can request for more information and details regarding this member

from IC by contacting Membership relations dept. 12th floor. Investor Club

Tel. 0 2666 9449 press 4 e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Application and annual Membership Fee

|

Application month

|

Juristic Member |

Individual Member |

||||||

|

Entry fee |

Membership

fee |

tax

7 % |

total

|

Entry fee

|

Membership

fee |

tax

7 % |

total

|

|

|

Quarter 1 (Jan – March ) |

5,000

|

2,000

|

490

|

7,490

|

2,000

|

1,000

|

210

|

3,210

|

|

Quarter 2 (Apr – Jun) |

5,000

|

1,500

|

455

|

6,955

|

2,000

|

750

|

192.50

|

2942.50

|

|

Quarter 3 (Jul – Sept) |

5,000

|

1,000

|

420

|

6,420

|

2,000

|

500

|

175

|

2,675

|

|

Quarter 4 (Oct – Dec) |

5,000

|

500

|

385

|

5,885

|

2,000

|

250

|

157.50

|

2,407.50

|

Remark :

- Membership ends December 31 every year

- Regular corporate member fee in subsequent year is 2,140 baht ( include VAT 7% )

- Regular individual member fee in subsequent year is 1,070 baht (include VAT 7% )

- Members whose memberships ends and do not pay the fee for subsequent year within 90 days may face termination of membership by IC. If wishing to re apply, juristic entry fee of 5,350 baht applies, and for individuals, this is 2,140 baht. (include VAT 7% )

-

Special Promotion for Membership

|

Membership type |

3 years membership

(fee include VAT 7 % ) |

5 years membership

(fee include VAT 7 % ) |

||

|

Juristic

|

Reg.Fee |

Discount 10% |

Reg.Fee |

Discount 15% |

|

6,420

|

5,778

|

10,700

|

9,095

|

|

|

Individual |

3,210

|

3,098

|

5,350

|

4,547.50

|

Remark : -entry fee for membership (include VAT 7 % )

- Juristic fee 5,350 baht

- Individual fee 2,140 baht

Regular Documents and Data

- BOI monthly magazine (12/year)

- BOI Monthly Investment Review (12/year)

- IC - E Newsletter every 2 months (6/year )

- Updated announcements of revised conditions, regulations, procedures of the BOI and IC

( by e-mails) - Monthly notices of IC seminars and training programs.

- List of promoted companies under the BOI

Participation in all membership events and networking

- Free admission to special keynote speakers (7/year)

- Factory visits to modern and successful operations at special rates

- Discounts of 10-40% in seminars and trainings by IC

- Special discounts for In-house Training

Privileges to enjoy other IC services

- Discounts of 10 -15% on purchase of books from IC

- Discount of 20% for use of computer room at IC

- Discount of 5% for translation services of IC

- Exercise voting rights at annual general meeting or being elected director of IC Board

|

|

|

|

|

|

Interested parties can request for more information and details regarding this member

from IC by contacting Membership relations dept. 12th floor. Investor Club

Tel. 0 2936 1429 ต่อ 201-204 fax: 0 2936 1441-2 e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

More...

Definition of membership and Types of Membership

Membership refers to a juristic person, or individual who applies for membership.

Currently, the majority of members are promoted companies with wide representations from different

industries and numbering over 1,200 companies located all over the Kingdom.

There are three different categories of memberships as follows :

1) Ordinary Member : companies, partnerships, individuals, current officers and staff of the Board

of Investment.

2) Extraordinary member : juristic persons or individuals as approved by the Board of IC

3) Honorary Member : individuals who are highly respected , of high character, patron or sponsor of

the Investor Club who have been invited to membership by the Board of IC.

Training sessions for RMTS, Import Online, eMT

1. Stock balance adjustment by computer system (Raw Material Tracking System: RMTS)

BOI promoted companies receive privileges for waiver or reduction of duties on materials under sections 30, 36 (1) (2) of The Investment Promotion Act B.E..2520 as amended ( 2nd. Amendment) B.E. 2534 can enjoy such privileges by following the conditions and procedures of the BOI.

Accordingly promoted companies will receive training on the key elements of the RMTS ( Raw Material Tracking System ) and how to use it efficiently and for maximum benefit to the company.

2. Materials release by Import Online”

The materials release by Import Online is available for promoted companies companies who receive privileges for waiver or reduction of duties on materials under sections 30, 36 (1) (2) of The Investment Promotion Act B.E..2520 as amended ( 2nd. Amendment) B.E. 2534 can enjoy such privileges by following the conditions and procedures of the BOI.

This Import Onlineoperates on the internet through the Investor Club website which is available 24 hours. Promoted companies will receive training on the key elements of the Import Online system.

3. Release of Machinery and Equipment by Electronic Machine Tracking System : eMT

Promoted companies receiving privileges for imports of machinery and equipment duty free under stipulations of sections 28 and 29 of The Investment Promotion Act B.E..2520 as amended ( 2nd. Amendment) B.E. 2534 which states that such machinery and equipment must not be the same as those manufactured or assembled in the Kingdom, having the same or similar quality as those imported , and which are available.

Accordingly promoted companies will receive training on the key elements of theeMTS(Electronic Machine Tracking System ) and how to use it efficiently and for maximum benefit to the company.

For enquiries or making bookings for Training and Seminars contact :

Tel: 0 2666 9449 press 3

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

In House Training

In house Training are tailor-made to meet the strategy / operational needs of the company.

Benefits of In house Training

1. The participants belong to the same organization with the same corporate culture which makes for an efficient

sessions as well as transfer of knowledge from the trainer.

2. The design of the training is geared to meet the needs of the organization and addressing directly the problem issues

3. The learning process is simultaneous for all participants and within the time frame allocated

4. Reduces the cost of training in terms of coordination, travel, hotels, etc. effectively lowering the cost per head.

5. Cost of training is tax deductible by 200%.

Topics for In-house Training include the following :

1. Topics related to investment promotions are :

1.1 How to proceed after receiving promotion certificate (CPD)

1.2 Things to know as a promoted company

1.3 Accounting and accounting audit for promoted companies (CPD)

1.4 How to deal with corporate income tax for promoted companies (CPD)

1.5 Procedures for start of operations for promoted companies

1.6 Procedures and problems related to rights and privileges under the Investment Promotion Act

1.7 How to proceed with waste materials for promoted companies

1.8 How to proceed with raw materials for promoted companies

1.9 How to proceed with machinery and equipments as a promoted company

1.10 How to deal with bringing in experts and skilled workers and procedures for applying for approvals as

a promoted company

1.11 All Executives Need to Know about BOI (ENGLISH VERSION)

1.12 All Executives Need to Know about BOI (JAPANESE VERSION)

1.13 All Executives Need to Know about BOI (CHINESE VERSION)

2. Topics on management and general issues as follows :

2.1 Customsdepartment procedures

2.2 Human Resource Management & Leadership

2.3 Leadership

2.4 Management

2.5 Sales & Marketing

2.6 Accounting & Finance

2.7 Services

2.8 Self Development

2.9 Purchasing

Applications for In-house Training process

1. Apply for In-house Training and indicating training needs to Investor Club at Tel : 02 936-1442 or e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

2. The Investor Club will carry out the needs analysis for training requirements and prepare a Tailored Made training program along with advice and recommendations for training for highest benefit and effectiveness.

3. Investor Club submits quotation for training along with topics covered, trainer’s background, and confirmation form

4. Company issues confirmation form for IC training program

5. IC contacts trainer giving profile of the company’s operations and needs.

6 .IC carries out training and follows up with evaluation report

Customers for the In House Training programs.

For enquiries on Training and Seminars contact :

Tel: 0 2666 9449 press 3

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it. or www.ic.or.th

Public Training

The Investor Club organizes training and seminar programs (Public Training) for the general public covering a wide range of topics for self improvements, practical application at work, and increase efficiency.

Public Training include the following:

1. Topics related to investment promotions are as follows :

| 1.1 How to proceed after receiving promoted status |  |

| 1.2 How to proceed with machineries and equipments for promoted companies |  |

| 1.3 How to proceed with waste materials for promoted compannies |  |

| 1.4 Things to know as a promoted company |  |

| 1.5 Procedures for start of operations for promoted companies |  |

| 1.6 How to deal with corporate income tax for promoted companies (CPD) |  |

| 1.7 Procedures and problems related to rights and privileges under the Investment Promotion Act. |

|

| 1.8 How to proceed with raw materials for promoted companies |  |

| 1.9 How to deal with bringing in experts and skilled workers and procedures for applying for approvals as a promoted company |

|

| 1.10 All Excecutives need to know about BOI (ENGLISH VERSION) |  |

| 1.11 All Excecutives need to know about BOI (JAPANESE VERSION) |  |

| 1.12 All Executives need to know about BOI (CHINESE VERSION) | |

| 1.13 Accounting and accounting audit for promoted companies (CPD) |

2. Topics on management and general issues as follows :

2.1 General management

2.2 Human resources management

2.3 Sales and Marketing

2.4 Quality Control of productions

2.5 Accounting and tax issues

2.6 Customs department procedures

2.7 Purchasing